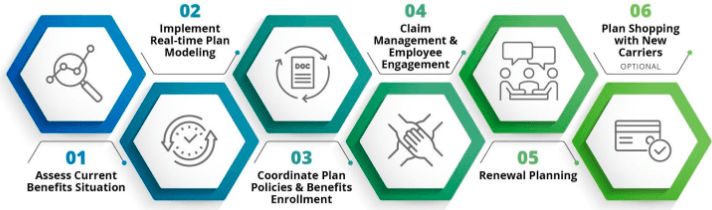

Employee Benefits

What Does an Employee Benefits Broker Do, Anyway?

We will assess your current benefits situation

This includes a deep dive into all your contracts as well as your claims history. They will patiently educate you on all of your options, and advocate for you if something in the process gets sticky (not that anything involving insurance companies is ever confusing).

We will steward the decision-making process so you can feel good about the choices you’re making on behalf of your employees.

When you meet with me, you’ll need to bring some essential information.

For example:

- How many employees you have

- How many of them qualify for employee benefits

- Knowledge of what you’re currently spending on healthcare

- A good understanding of what your budget is for the coming year

- A list of companies with whom you compete for talent.

I will show a variety of options from multiple insurance companies and then crunch the numbers with you to determine which is the best fit for you and your employees.

Coordinate Plan Policies & Benefits Enrollment

We will coordinate with the insurance carriers to make sure your group health, dental, vision, life, disability (and other) policies are in place. At this point, we will provide the necessary tools to automate the benefits enrollment process and assist you in setting things up and make sure that other systems (like payroll) are working in parallel with the new program.

Claim Management, Employee Engagement & Compliance

Upon completion of your first open enrollment campaign, we will stay by your side to:

- Actively help you manage large claims

- Provide assistance to your employees who have benefit questions or claims issues

- Help to ensure you remain compliant with federal, state and local regulations

We will also assist with new hire benefits on-boarding, newly Medicare eligible as well as cobra administration for employees leaving the company. We will create a tailored year round communications calendar typically focused on workforce wellness and promotion of benefit programs such as preventative care benefits, new mother maternity programs, biometric screenings, upcoming enrollment periods, etc.

Renewal Planning & Preparation

About seven or eight months into the plan year we will start working on your renewal for the following year. Working closely with the incumbent carriers, they'll assess how all of your plans are performing for the current year and discuss any adjustments that need to be made in terms of plan design. This might include adjustments to employer and employee contributions, HSA funding, deductibles and copayments, physician networks, and pharmacy formularies.

This is also when the carriers will propose rates for the upcoming year, assuming you aren't in a multi-year contract. If the rates are unfavorable (e.g. a significant or unjustified increase vs. current year), your broker will negotiate with the carriers in an attempt to obtain a more reasonable and justifiable figure.